Federal Budget 2019: What it means for you

The Federal Treasurer, the Hon. Josh Frydenberg MP, delivered the 2019 Federal Budget on 2 April 2019.

As widely predicted, the announcement included a range of tax cuts for both individuals and businesses. The Treasurer also announced increased funding for regulators to encourage tax and superannuation compliance, a number of positive changes to superannuation, and an affirmation of previously announced aged care measures.

This summary provides coverage of the key issues of most interest to you.

Highlights

Personal income tax

- Increases in the low and middle income tax offset to apply in 2018-19.

- Other tax benefits (tax rates/thresholds and low income tax offset changes) to commence in 2022-23 and later income years.

Business owners

- Extension of the provision allowing small business to instantly write-off asset purchases.

- Further consultation on Division 7A reform.

Superannuation

- Work Test changes.

- Spouse contributions.

- Bring-forward of the NCC cap.

- Tax relief for merging superannuation funds.

- ECPI administration simplification.

Social Security

- Energy Assistance Payment.

Aged care

- Improving the quality, safety and accessibility of aged care services.

Personal income tax

The Government will lower taxes for individuals by building on its legislated Personal Income Tax Plan, announced in the 2018 Federal Budget. The changes to the plan will provide immediate relief to low and middle income earners, support consumption growth and ease cost of living pressures.

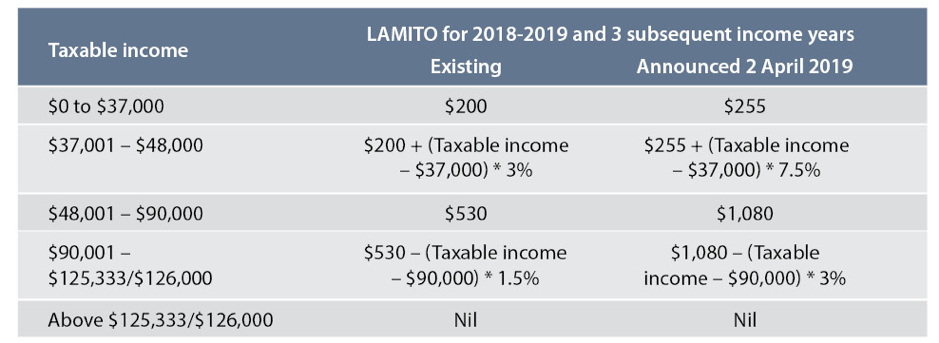

Low and Middle Income Tax Offset from 1 July 2018

The Government will provide a further reduction in tax provided through the non-refundable low and middle income tax offset (LAMITO).

LAMITO for 2018-19 and 3 subsequent income years

[/vc_column_text]

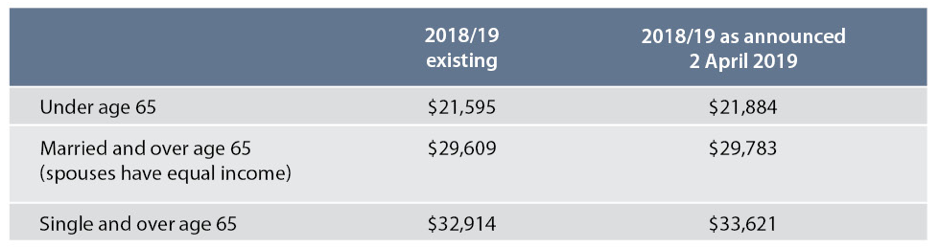

This measure increases the effective tax-free thresholds as follows:

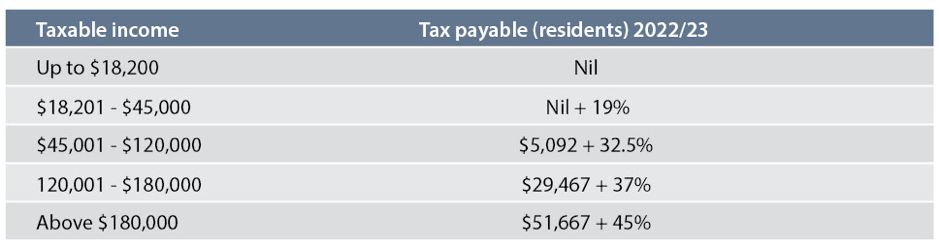

Increase in tax bracket thresholds from 1 July 2022

From 1 July 2022, the Government will increase the top threshold of the 19 per cent personal income tax bracket from $41,000, as legislated under the plan, to $45,000.

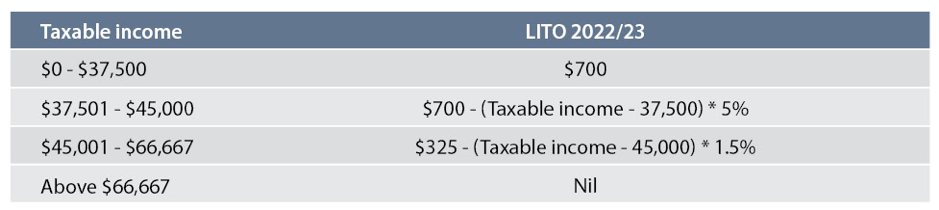

Low Income Tax Offset from 1 July 2022

From 1 July 2022, the Low Income Tax Offset (LITO) will be increased to a maximum $700 for those with taxable income less than $37,500. LITO will phase out at 5% in the income range from $37,500 to $45,000, and at 1.5% thereafter.

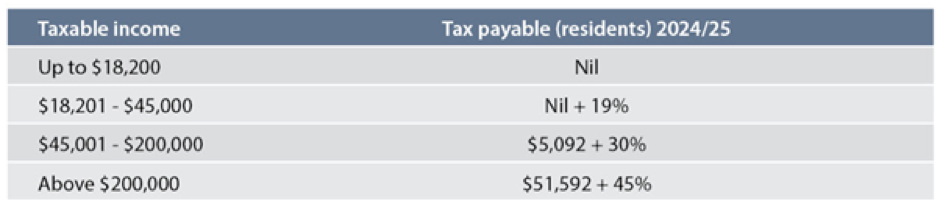

Reduced marginal tax rate from 1 July 2024

From 1 July 2024/25, the Government will reduce the 32.5 per cent marginal tax rate to 30 per cent. This will more closely align the middle tax bracket of the personal income tax system with corporate tax rates, improving incentives for working Australians. In 2024/25 an entire tax bracket, the 37 per cent tax bracket will be abolished under the Government’s already legislated plan. With these changes, by 2024/25 around 94 per cent of Australian taxpayers are projected to face a marginal tax rate of 30 per cent or less.

Medicare levy thresholds for 2018/19

The threshold for singles will be increased from $21,980 to $22,398. The family threshold will be increased from $37,089 to $37,794. For single seniors and pensioners, the threshold will be increased from $34,758 to $35,418. The family threshold for seniors and pensioners will be increased from $48,385 to $49,304. For each dependent child or student, the family income thresholds increase by a further $3,471, instead of the previous amount of $3,406.

On-time payment of tax and superannuation liabilities

The Government will provide $42.1 million over four years to the ATO to increase activities to recover unpaid tax and superannuation liabilities. These activities will focus on larger businesses and high wealth individuals to ensure on-time payment of their tax and superannuation liabilities. The measure will not extend to small businesses.

Business owners

Increasing and expanding access to the instant asset write-off

From 7:30 PM (AEDT) on 2 April 2019 (Budget night), the Government is increasing and expanding access to the instant asset write-off.

The Government is increasing the instant asset write-off threshold from $25,000 to $30,000. The threshold applies on a per asset basis, so eligible businesses can instantly write off multiple assets.

Medium sized businesses will now also have access to the instant asset write-off.

The increased and expanded instant asset write-off will apply from Budget night until 30 June 2020.

Arrangements prior to Budget night

The Government has already legislated a $20,000 instant asset write-off for small businesses. Eligible small businesses can already immediately deduct purchases of eligible assets costing less than $20,000 that are first used or installed ready for use by 30 June 2019.

On 29 January 2019, the Government announced that it would increase the instant asset write-off threshold for small businesses from $20,000 to $25,000 and extend the instant asset write-off for an additional 12 months to 30 June 2020.

These changes interact with the changes being announced as part of Budget. This means that, when legislated, small businesses will be able to immediately deduct purchases of eligible assets costing less than $25,000 that are first used or installed ready for use over the period from 29 January 2019 until Budget night.

Further consultation on amendments to Division 7A

The Government will defer the start date of the 2018-19 Budget measure, Tax Integrity – clarifying the operation of the Division 7A integrity rule, from 1 July 2019 to 1 July 2020. Division 7a is part of the Income Tax Assessment Act 1936, and aims to prevent profits or assets being provided to shareholders or their associates tax free. The 2018/19 Budget measure was intended to address unpaid present entitlements. Delaying the start date by 12 months will allow additional time to further consult with stakeholders on these issues and to refine the Government’s implementation approach, including to ensure appropriate transitional arrangements so taxpayers are not unfairly prejudiced.

Superannuation

Work test changes

From 1 July 2020, Australians aged 65 and 66 will be able to make voluntary superannuation contributions, both concessional and non-concessional, without meeting the Work Test.

Currently the Work Test (a minimum of 40 hours worked over a 30 consecutive day period in the financial year of contribution) applies from a superannuation fund member’s 65th birthday.

This change will align the superannuation Work Test with the eligibility age for the Age Pension, which is scheduled to reach age 67 from 1 July 2023.

Spouse contribution age limit

The maximum age at which a spouse contribution can be made will be increased from age 69 to age 74. The limit applies to the age of the spouse into whose superannuation account the spouse contribution is being made.

Currently those aged 70 and over cannot receive contributions made by another person, including a spouse, on their behalf.

This measure was announced in conjunction with the Work Test changes outlined above.

NCC bring-forward arrangements

The cut-off age for the bring-forward of up to two future years of the non-concessional contribution (NCC) will be extended by two years. This means NCCs of up to $300,000 can be made in one financial year.

Currently the bring-forward arrangement applies until 30 June in the financial year the superannuation fund member turns age 65. This will be extended to allow those aged 65 and 66 to use the bring-forward arrangement.

This measure was announced in conjunction with the Work Test changes outlined above.

Permanent tax relief for merging superannuation funds

The Government will make permanent the current tax relief for merging superannuation funds that is due to expire on 1 July 2020.

Since December 2008, tax relief has been available for superannuation funds to transfer revenue and capital losses to a new merged fund, and to defer taxation consequences on gains and losses from revenue and capital assets.

The tax relief will be made permanent from 1 July 2020, ensuring superannuation fund member balances are not affected by tax when funds merge. It will remove tax as an impediment to mergers and facilitate industry consolidation. Consolidation would help address inefficiencies by reducing costs, managing risks and increasing scale, leading to improved retirement outcomes for members.

ECPI calculations

The Government will reduce costs and simplify reporting for superannuation funds by streamlining some administrative requirements for the calculation of exempt current pension income (ECPI).

The Government will allow superannuation fund trustees with interests in both the accumulation and retirement phases during an income year to choose their preferred method of calculating ECPI.

The Government will also remove a redundant requirement for superannuation funds to obtain an actuarial certificate when calculating ECPI using the proportionate method, where all members of the fund are fully in the retirement phase for all of the income year.

This measure will start on 1 July 2020.

Social security

Energy Assistance Payment

The Government will provide $284.4 million over two years from 2018-19 to make a one-off Energy Assistance Payment of $75 for singles and $62.50 for each member of a couple eligible for qualifying payments on 2 April 2019 and who are resident in Australia.

Qualifying payments are the Age Pension, Carer Payment, Disability Support Pension, Parenting Payment Single, the Veterans’ Service Pension and the Veterans’ Income Support Supplement, Veterans’ disability payments, War Widow(er)s Pension, and permanent impairment payments under the Military Rehabilitation and Compensation Act 2004 (including dependent partners) and the Safety, Rehabilitation and Compensation Act 1988.

This measure builds on the 2017-18 Budget measure titled Energy Assistance Payment.

Aged care

Improving the quality, safety and accessibility of aged care services

The Government affirmed its announcement on 10 February 2019 issued by the Prime Minister, Minister for Health and Minister for Senior Australians and Aged Care to provide $724.8 million over five years from 2018-19 to support older Australians through further improvements to the quality, safety and accessibility of residential and home care services.

Source: Macquarie April 2019